India, China, USA & World GDP

- NAMRATA MUNOTH

- Jul 25, 2019

- 3 min read

How long will India take to become a US$ 5 Trillion economy?

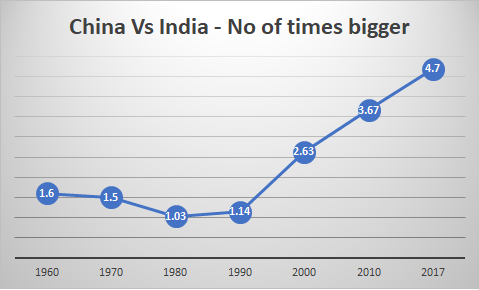

The economy of China was just slightly larger than India in 1990, the year I was born. The nineties saw unprecedented growth in the Indian economy but we still lost out in the race with China. Why? Because China grew an unimaginable four times that of India and that too not for a decade but for over two decades. These two Asian countries that had started off as being equal sized economies then are now far apart in the standings. The Chinese economy is today five times that of India and sadly, the only equation between China & India remains that of population. The world GDP as per latest reports is around US$ 85 trillion. 25% of this is contributed by the US, 15% by China and India while maintaining around 18% of the world's population contributes just a little over 3% to world GDP.

So how did this communist country which is the most populous country in the world grow so rapidly in a relatively short period of time? China grew by becoming the manufacturing hub of the world. The Chinese government encouraged manufacturing by granting generous subsidies. Attractive foreign policies were formulated and this not only ushered in investments but also brought in expertise. Exports swelled because of enormous export incentives making Chinese made goods beyond the reach of other manufacturers around the world. India’s GDP currently stands were China’s stood at in 2006. At that time, China took under three years to cross the US$ 5 trillion mark. Can India do it in five years now?

India is right now at its weakest in the last five years. Automobile sales plummeted in 11 out of 12 recent months. The banking sector & NBFC's are facing a crunch situation and credit off-take has taken a hit. The Government's 'Make-in-India' program doesn’t seem to have really taken off even after five years of launch. In real GDP terms, India’s growth is only edging to 6% whereas the country needs the double of that. The Central Government while desiring major growth from the export sector on one hand, seems to be trying to exercise control to keep deficits around 3.3% on the other. Fierce competition from the likes of South Korea & Vietnam might affect India’s exports and as a result, the sector might not contribute as much to growth as the government would like it to. India no longer holds preferential access to the US market which is India's largest export territory. As per the norms set forth by the World Trade Organisation, Governments around the world can no longer offer generous subsidies to encourage exports. Growth in exports therefore only has to come out of sheer efficiency.

The bright side: India's sovereign debt expressed as a percentage of GDP is less than 5%, one among the lowest in the world and much lower than the 20% that many countries including Brazil have. There is potential for major investments in infrastructure, industries & agriculture. About half of Indians still live in rural areas, many of whom can be productively engaged. The country has the highest percentage of working population in the world, and average salaries here are 2 to 3 folds lower than that in China. There lies a great opportunity to realize the full potential of this massive country and take away the “world manufacturing hub” tag from China.

We are traversing on gravel road, and investors need to be fully alert to stay away from pitfalls. Emerging technologies can disrupt businesses of many companies and rattle industries. Investments, if smartly made, can however generate very high returns over the next four to five years. Industries which we think are likely to excel in the times to come are agriculture, IT, infrastructure, automobiles and engineering. Our best picks for now are Bosch, Siemens, M&M, ITC, Reliance Industries, TCS and L&T.

Munoth Financial Services Ltd, incorporated in the year 1990, has delivered average annualized returns of 16.36% to its Portfolio Management clients over the last five years. To know how you can take advantage of the promising prospects that this country holds to make a fortune for yourself, get in touch with us.

Statutory note:

Investments in stocks is subject to market risk. Past performance stands no guarantee to future returns.

Comments